nj property tax relief check

Military Personnel Veterans. Now incomes over 1 million are taxed at a rate of 1075 up from the previous top rate of.

Nj Property Tax Relief Program Updates Access Wealth

If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception.

. That means if the amount on line 50 is less than 500 you will receive a. 870000-plus homeowners with a. Roughly 870000 homeowners will qualify for a check of.

Income tax refund checks of up to 800 will be. See if you Qualify for IRS Fresh Start Request Online. It increases income eligibility for renters by 50000 opening the program to an additional 300000 renters.

We will mail checks to qualified applicants as. Buying Selling Transferring Property. About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion.

Some two million New Jersey households are getting property tax. Ad Owe back tax 10K-200K. The Homestead Benefit program provides property tax relief to eligible homeowners.

Income Tax Resource Center. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. In 2021 the average New Jersey property tax bill was about.

100s of Top Rated Local Professionals Waiting to Help You Today. NJ Earned Income Tax Credit. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the.

The rebate amount is equal to the tax paid after credits line 50 up to a maximum amount of 500. The checks part of a deal Murphy cut with top Democratic lawmakers last year to institute a millionaires tax come as the governor vies for a second term and as all 120 seats. NEW JERSEY If you like many others have been financially hit.

Ad You Dont Have to Face the IRS Alone. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. Check Your Refund Status.

4 weeks or more after you file electronically. Ad Owe back tax 10K-200K. The Ocean County Board of Taxation is one of the more advanced assessment systems in the State of New Jersey.

Enough already said Murphy at the time. For homeowners the savings increase from about 700 for. Civil Union Act Implementation.

See if you Qualify for IRS Fresh Start Request Online. But literally in the center top of the check under Trenton New Jersey 08695 It says Property Tax Relief Fund. Board of Commissioners.

Homeowners making up to 250000. If a reimbursement has been issued the system will tell you the amount of the reimbursement and. At least 12 weeks after you mail your return.

When can you start checking your refund status. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Property Tax Relief Programs.

NJ budgetLawmakers approve 464 billion spending planWhat you need to know. For most homeowners the benefit is distributed to your municipality in the form. The property tax rebates for homeowners would be boosted to 1500 and renters would get 450 checks to offset rent increases related to property taxes.

NJ property tax relief to expand. Under this plan the government will also send renters who make less than 150000 a direct check for 450. Get the Help You Need from Top Tax Relief Companies.

Our Knowledgeable Professionals Can Answer Your Tax Questions. Local Property Tax Forms. Ad Tax Relief Experts Attorneys Work Hand in Hand to Help You Resolve Taxes for Much Less.

A 2 billion property tax relief program signed by Gov. Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. Give Us a Call Today.

Local Property Tax Relief Programs. Under the expanded ANCHOR property tax relief program proposal there will be a full phase-in of rebates and the benefits will be simplified. Households with income below 150000 will receive a property tax credit for their 2023 property tax bill worth 1500.

New Jerseys Property Tax Relief Programs. The property tax relief was only at levels it was supposed to be for one year-- in 2007.

Murphy Touts Historic And Direct Property Tax Relief As He Signs 50 6b N J Budget Nj Com

Township Of Nutley New Jersey Property Tax Calculator

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

Stimulus Update New Jersey Homeowners Could Earn Up To 1 500 In Property Tax Relief Who Qualifies Gobankingrates

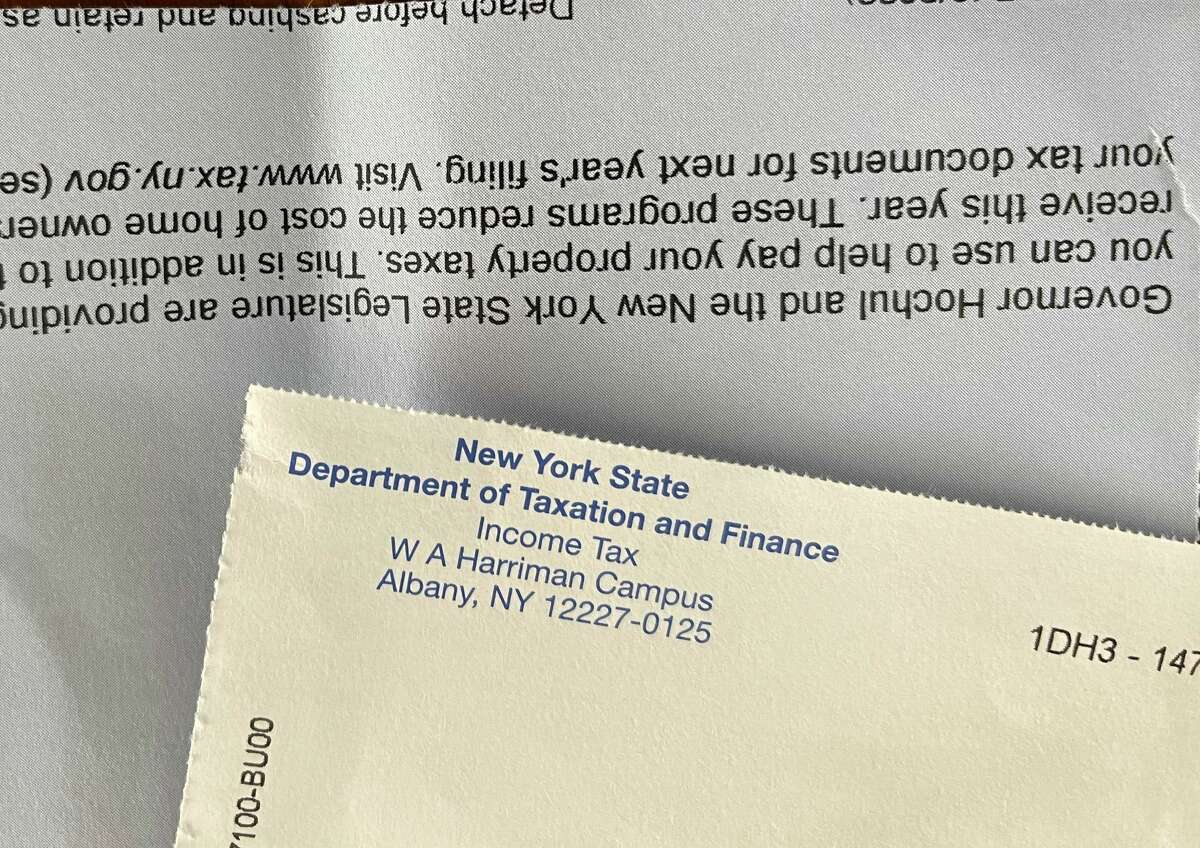

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Home Buying Buying A New Home

The Official Website Of City Of Union City Nj Tax Department

Property Tax How To Calculate Local Considerations

How Taxes On Property Owned In Another State Work For 2022

2022 Property Taxes By State Report Propertyshark

Murphy Announces Details Of Property Tax Relief Program Whyy

New York Property Owners Getting Rebate Checks Months Early

Real Property Tax Howard County

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)